I thought that I could have success in the stock market. I was wrong! When I started my trading account in 2014, it was easy to pick winners. It seemed like I couldn’t miss when buying stocks and ETF’s on the Canadian and US exchanges. I would buy shares because I heard positive stories from friends who worked at companies like SNC Lavilan, Westjet, CNRL, Bellatrix, etc that the time was now to buy stock. In that time frame the TSX was preforming well, and I enjoyed gains of 10-30+%. I was floored by my success, and my stocks that preformed poorly, I would ignore them by thinking my gains would surely outweigh them.

So today, amidst the economic slow down, I have this inadequate trading account that has lost 50% of its value. The lessons I have learned as an amateur investor,

- DON’T PICK STOCKS

- DIVERSIFY! Because I work in the oil and gas industry, the bulk of my investments should be in other market segments. (I call this the rule of ‘dont sh** where you eat’)

I began banking with Tangerine last year to reduce my overhead. Little did I know, Tangerine had retained some of the best index funds in Canada from ING direct. From a straight investing standpoint, the funds are still one of the best ways to become and index investor without any hassle. Yes, there are cheaper options available, but with the Tangerine funds, you can start indexing right away and do you banking in one place all for a low cost.

One of the biggest benefits of Tangerine’s investment funds have a management expense ratio (MER) of 1.07%, whereas standard mutual funds charge a MER around 2.5%. That’s a huge savings over your investment lifetime.

What are index funds?

Index funds are essentially a type of mutual fund where its holdings are meant to match a certain market index. Since an index comprises of the stock of thousands of companies, it allows an investor to be well diversified. There are many different indexes, but the Tangerine investment funds try to mimic the following indexes.

- FTSE TMX Canada Universe Bond Index – Canadian Bonds

- S&P/TSX 60 Index – Canadian Stocks

- S&P 500 Index – US Stocks

- MSCI EAFE (Europe, Australasia and Far East) Index – International Stocks

There are 5 portfolios available at Tangerine, and they are allocated based on risk. Low risk meaning bonds and high risk meaning stocks. You can look at the distribution and holding on the Tangerine website.

I chose the Balanced Growth Portfolio for my RRSP. I chose a medium risk portfolio because I knew that I would hold this for many (30+) years, and could tolerate some fluctuations in the market. Disclaimer: To each their own, this isn’t for everybody, if you are saving for retirement vs other goals there are many other options to consider, and maybe one of the portfolios is better suited to you.

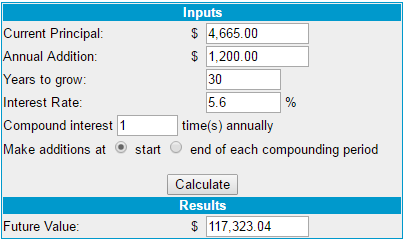

In 11 months I have made $291.16, this is a 6.65% gain from my book value. Tangerine will collect their MER of 1.07%, so that leaves me with a modest gain of 5.58%. (In the other banks mutual funds you would be taking home 3%). These numbers aren’t overly sexy, but keep in mind that 2016 had been a down year in the markets. Here is where this gets interesting, IF I just maintain adding $100 per month to my RRSP (plus a nice tax rebate in the spring), at this current rate 5.6%, by the time I am in retirement, my savings will have increased to $117,323 !!! That is enough to buy the nicest Cadillac at the retirement home!

In 11 months I have made $291.16, this is a 6.65% gain from my book value. Tangerine will collect their MER of 1.07%, so that leaves me with a modest gain of 5.58%. (In the other banks mutual funds you would be taking home 3%). These numbers aren’t overly sexy, but keep in mind that 2016 had been a down year in the markets. Here is where this gets interesting, IF I just maintain adding $100 per month to my RRSP (plus a nice tax rebate in the spring), at this current rate 5.6%, by the time I am in retirement, my savings will have increased to $117,323 !!! That is enough to buy the nicest Cadillac at the retirement home!

http://www.moneychimp.com/calculator/compound_interest_calculator.htm

If you have $100 or $100,000 to invest there is no time better than now to start index investing for you future! There are lots of options out there, but I have had a positive experience with Tangerine, and it is really nice to have all of my banking in one place. If you want to get started banking or investing with Tangerine, read my other blog post: Step 1: Reduce Banking Fee’s . And don’t forget to put in my orange key for a $50 bonus! Open a Tangerine Account with my Orange Key 44109967S1 and get a $50 Bonus! Visit tangerine.ca/referafriend